Know Your Customer (KYC) software automates the mandatory process of verifying a customer's identity when they open an account and, occasionally, over time. It's how regulated industries prevent fraud and ensure regulatory compliance.

However, automation alone isn't enough—it must also meet regulatory requirements. According to Forrester's 2023 True Cost of Financial Crime Compliance study, 82 percent of financial institutions must adhere to strict regulations, while 85 percent also prioritize improving user experience.

Striking the right balance between compliance and a seamless user experience is challenging. However, incorporating KYC doesn't have to mean sacrificing user experience. With the right tools, you can effectively balance both compliance and user experience. This article explores some of the features that KYC tools offer as well as best practices for reducing user friction.

Despite the availability of automated identity verification tools, many organizations still rely on manual processes. According to Fenergo, a leading KYC and onboarding solutions provider, many financial institutions heavily depend on manual steps, which increases onboarding costs. Consequently, new customers often have to submit physical documents and wait for back-office reviews, which is not only annoying but also time-consuming.

Back-office systems operate in silos, forcing compliance officers to manually cross-check data across multiple databases. Without automated tools, teams must manually extract and enter information from various documents, increasing the chance of errors.

This challenge grows even more complex with international customers, who bring not only different document types and compliance formats but also diverse privacy regulations. For example, some areas have strict data localization laws. They also require clear consent under rules like the General Data Protection Regulation (GDPR). This adds yet another layer of complexity to the verification process.

Forrester's study also highlights escalating compliance costs, with 98 percent of institutions reporting increases in both direct costs (like manual processing) and indirect costs (like delayed onboarding.

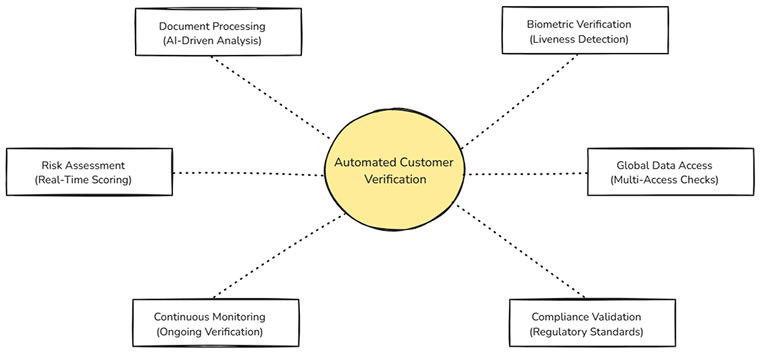

AI engines for document analysis (computer vision), text extraction (natural language processing (NLP)), and signature verification (pattern recognition) analyze and verify submitted documents in real time. For instance, KYC software might use optical character recognition (OCR) to scan a driver's license, extract the owner's name and date of birth, and check for authenticity markers. Convolutional neural networks (CNN) perform image analysis, quickly flagging suspicious documents and generating real-time risk scores.

Biometric verification adds another security layer by confirming a user is physically present and matches their ID. Common methods include facial recognition with liveness detection, fingerprint scanning, and voice recognition.

However, real-world data breaches like Signzy, Transak, and Fractal ID, highlight the privacy risks of storing biometric data in centralized repositories.

To mitigate these threats, some providers adopt on-device processing, as seen with EnQualify, which uses AI at the mobile edge to keep sensitive information on the user's device.