Built on trust, proven by experience. Meet our customers

India's leading content distribution platform

India's leading digital commerce company

India's leading Fintech company

India's leading content distribution platform

India's leading content distribution platform

Bangladesh's leading content distribution platform

India's leading content distribution platform

India's leading digital commerce company

India's leading Fintech company

India's leading content distribution platform

India's leading content distribution platform

Bangladesh's leading content distribution platform

Why Financial Institutions

Trust AShield

Synthetic Identity

Fraud

Binds every action to real, verified user + device + SIM with quantum-immune authentication.

Deepfake Social Engineering

Continuous, real-time verification to silently validate presence, behavior, and device.

Phishing &

ATOs

Remove all phishable factors—no passwords, OTPs, or soft tokens to steal.

Real-Time Payment

Fraud

Authenticates every critical action with real-time, session-aware cryptographic binding.

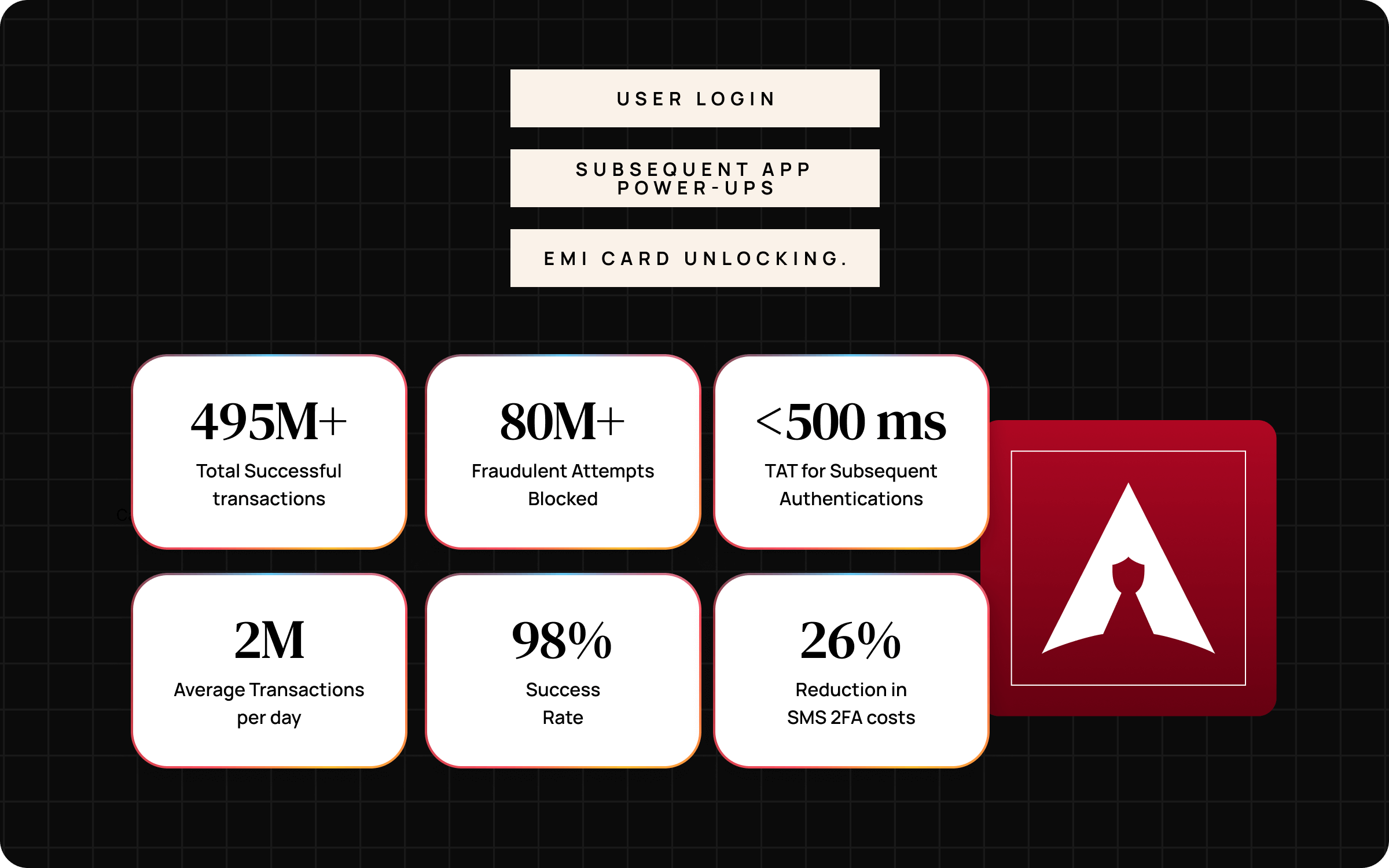

Secure Every User In

Your Business

Account Login

Passwordless, device-bound login with

no OTPs or phishable factors.

Onboarding & eKYC

Ensures the applicant is a real human tied to

a verified SIM and device.

Loan Disbursals

Authenticates high-risk payout events silently

and in real-time.

UPI/IMPS/RTGS Transfers

Verifies session continuity and blocks injection or replay attacks mid-transaction.

BNPL & Credit Line Access

Secures every credit event with dynamic risk enforcement and invisible checks.

Mobile App Transactions

Ties each action to the user's mobile hardware and SIM, preventing fraudulent automation.

Integration so smooth, it's

practically telepathic

We slide into your stack

like we were born there

Connect in minutes—no disruption, no heavy lifting.

Native Feel

Instantly fits into your existing workflows without extra overhead.

Frictionless Setup

Go live in minutes

with minimal configuration.

Security That Flows

Runs silently in the background, securing without slowing you down.

Partnered with the best in the business

Google Cloud Platform

Microsoft Azure